The Canadian real estate did not see a slow rate of growth despite the other industries being affected highly by COVID-19. The data from Statistics Canada (Stat Can) shows that the residential investment was at an all-time high in the third quarter of 2020, clearly indicating that the growth rate has far outpaced the Canadian economy making residential investment as the biggest percentage of GDP ever.

Residential Investment

The investment that people make in residential properties is a direct contribution to the country’s GDP. This includes ownership transfer fees, construction and renovation costs, etc. Adjacent industries like finances and insurance are also in their own category.

The Canadian Residential Investment has risen over 18%

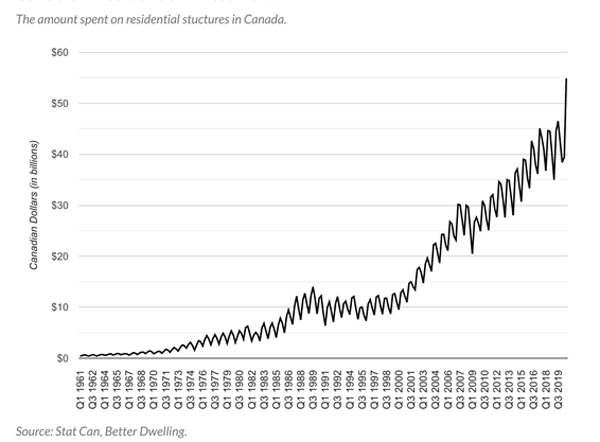

The amount that is currently dedicated to residential investment in Canada is increasing by the day, with the total in the third quarter reaching to $54.89 billion, which is up 39.34% from the quarter before, representing an increase of 18.03% in comparison to the same quarter the year before. The increase shows that this number shows a huge rate of growth, making it the biggest number ever.

Canadian Residential Investment

Following the low in the second quarter of 2020, the rate shows a general increase over the next quarter and forth for the increase in the residential investment was high. The rate is generally increasing from the end of 2019, but this is the largest rate of growth seen since 2010.

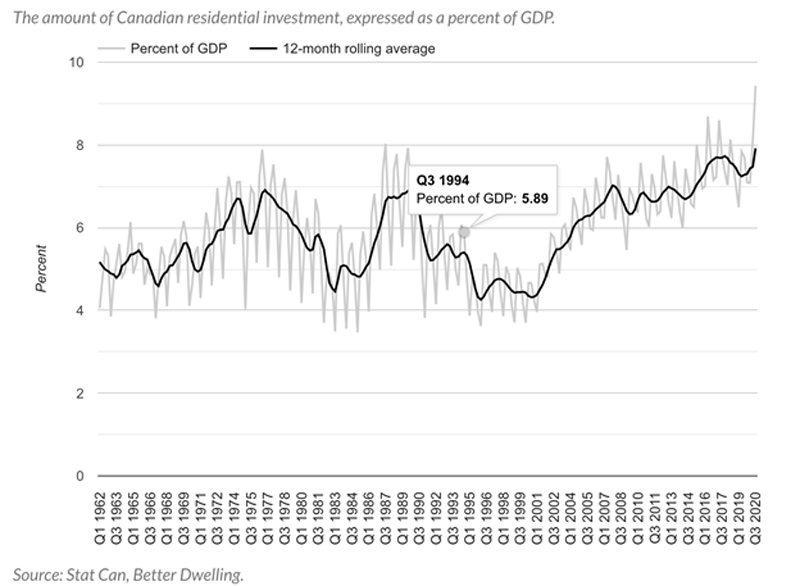

Canadian Residential Investment at 9.43% Of GDP

The investment in residential properties has recovered much faster than the other segments of the GDP. In the third quarter of 2020, it was at 9,43%, up from 7.71% in the same quarter, last year, making the rise not only the highest rate seen in the past 60 years, but also the highest in comparison to other countries. to give you an example, the residential investment in the United States at 6.7% in 2006 during the housing bubble, while the current rate in the US is just at 4.3%. Even though this rate has increased faster than the GDP in the third quarter, it is still not as much as in Canada.

Residential Investment As A Percent Of GDP

The residential investment so more than likely a growth delay in the second quarter, Does slowing down the growth in the subsequent quarters as the pent up demand catches up. Though we still have to wait and see how that pans out, it is important to remember that it was already a high percentage of the GDP before the pandemic.